working in nyc taxes

If you live in NJ you save the city tax but still will pay NY state taxes which will cover your NJ taxes. New York City has four tax brackets ranging from 3078 to 3876.

The Complete Guide To Buying A Townhome In Nyc Hauseit Townhouse Nyc Complete Guide

Most New York City employees living outside of the 5 boroughs hired on or after January 4 1973 must file Form NYC-1127.

. May 18 2022 242 PM. If you are a nonresident you are not liable for New York City personal income tax but may be subject to Yonkers nonresident earning tax if your income is sourced to. Best of all you wont have to pay NYC income taxes which only apply to residents of New York City.

But there are subtleties. Its called the Resident Credit. In New Jersey the value is only a fraction of that at 421124 and.

Has the deadline for NYC employees required to file Form NYC-1127 been extended. People trusts and estates must pay the New York City Personal Income Tax if they earn income in the City. Minimum of 3 seasons of paid Tax Preparation experience with a minimum of 30 tax returns per tax year required.

The deadline for filing your Form NYC-1127 and paying any amount due has been extended to June 1 2021 in response to the extensions of the Federal and New York personal income tax filing deadlines to May 17 2021. Who Work 14 Days or Fewer in New York State. This memorandum explains the Tax Departments existing policy concerning employer withholding on the wages paid to certain nonresident employees whose primary work location is outside of New York State and who are expected to work 14 days or fewer in New York State during the calendar year.

That might reduce your CT tax to zero it might not depending. You should do the NY non-resident return first because you need to know the amount you owe to NY for the CT credit. Certain additional regulations apply for employees who are resident in New York City.

The ideal candidate will have a background in business finance accounting or tax. Living in Queens vs Manhattan has the same income taxes. If you are an employer as described in federal Publication 15 Circular E Employers Tax Guide and you maintain an office or transact business within New York State whether or not a paying agency is maintained within the state you must withhold personal income tax.

NY will tax you only on money made in NY CT will tax you on income you earn worldwide but give you a credit for tax paid to other states. Yes you will get credit on your New York tax return for the tax that you pay to New Jersey. A financial advisor in New York can help you understand how taxes fit into your overall financial goals.

Residents of New Jersey who work in New York will fill out both an NJ Resident Income tax return and a NY Nonresident Income tax return. Under ordinary circumstances if you have been. As a nonresident you only pay tax on New York source income which includes earnings from work performed in New York State and income from real property located in the state.

New York City residents must pay a Personal Income Tax which is administered and collected by the New York State Department of Taxation and Finance. As a nonresident youll have to pay NYS tax on your New York-derived income and Florida tax 000 on your Florida-derived income. College degree a plus.

The lowest rate applies to single and married taxpayers who file separate returns on incomes of. If you live in NYC your effective all-in tax rate will be 34. Financial advisors can also help with investing and financial planning - including retirement homeownership insurance and more - to make sure you are preparing for the future.

Your employer will then withhold your New York taxes and report your income to the state of New Jersey. How You Can Affect Your New York Paycheck. Prior tax preparation experience in a tax practice or retail setting required.

Your employer will have withheld New York state taxes throughout the year but youll need to file in New Jersey as well. October 1 2021 The onset of the COVID-19 pandemic in March 2020 coupled with the rise in New York individual income tax rates that became effective in April 2021 spurred many individuals to move out of New York and. If you find yourself always paying a big tax bill in April.

You will have to file two state tax returns a New Jersey nonresident tax return and a New York resident tax return. What is NYC income tax rate 2020. But theres a wrinkle.

As of August 2021 the average value of a residential house has risen to 722787a 45 increase from 2020 levels. Rates kick in at different income levels depending on your filing status. If youre working for a New York employer from home youll have to jump through quite a lot of hoops to prove that your home is a bona fide business location of your employer.

The tax is collected by the New York State Department of Taxation and Finance DTF. Non-resident Employees of the City of New York - Form 1127. The New York tax return includes both New York State and New York City taxes.

Remote Workers May Owe New York Income Tax Even If They Havent Set Foot in the State By Jennifer Prendamano James Jay M. The tax usually shows up as a separate line on pay stubs. Withholding tax requirements Who must withhold personal income tax.

The boroughs are still NYC. If you max your 401k thats lowered to 30. New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax Return Form NJ-1040.

What A Fashion Editor S Salary Can Get You In Nyc Fashion Editor Salary Fashion

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vid Income Tax Preparation Tax Services Flyer

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Media Center Top 5 Overlooked Home Related Tax Deductions Homeowner Taxes Property Tax Estate Tax

Pin On Buying An Apartment In Nyc

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into V Business Tax Flyer Template Tax Preparation

What Is The Difference Between Social Security Disability Insurance Ssdi And Sup Social Security Disability Supplemental Security Income Disability Insurance

Cpa For Freelancers And The Self Employed In Nyc Small Business Cpa Manhattan Cpa Self Employed Nyc Cpa W Certified Public Accountant Cpa Business Advice

What A Fashion Editor S Salary Can Get You In Nyc Fashion Editor Career In Fashion Designing Salary

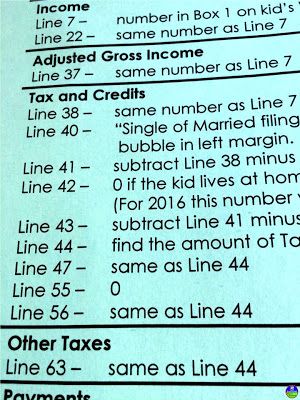

1040 Income Tax Cheat Sheet For Kids Income Tax Consumer Math Financial Literacy

Nyc Real Estate Taxes 101 Estate Tax Paying Off Credit Cards Utah Divorce

Tax Flyers Accounting Services Accounting Tax Consulting

Create The Perfect Design By Customizing Easy To Use Templates In Minutes Easily Convert Your Image Designs Into Vi Flyer College Quotes Social Media Graphics

Small Biz Owner You Need Turbotax Self Employed Turbotax Filing Taxes Finances Money

Tax Accountants Irs Enrolled Agents Tax Accountant Income Tax Return Filing Taxes

How Much Can Realtors Make Nyc Hauseit Nyc Real Estate Marketing Realtors

401k High Taxes Conniebarker Wfgopportunity Com Entrepreneur Quotes Finance Education Inspirational Quotes